Reinventing Liquidations (Part 1)

A primer on Fluid and Jupiter lend liquidation mechanism

In the world of decentralized finance, liquidations represent one of the most critical yet inefficient processes. When borrowers become undercollateralized, traditional protocols face a fundamental bottleneck, they must liquidate positions one by one, creating massive gas costs, market disruption, and suboptimal outcomes for everyone involved. Fluid Protocol (Jupiter lend on Solana) has solved this problem by reimagining how risk is organized and managed, introducing a tick-based architecture that enables batch liquidations and transforms the economics of DeFi lending.

The Liquidation Crisis in Traditional DeFi

Every major DeFi lending protocol faces the same problem, inefficient liquidations that constrain the entire system’s potential. When market volatility strikes, hundreds or thousands of borrowing positions may simultaneously become undercollateralized. Traditional protocols handle this by requiring liquidators to process each position individually, a fundamentally flawed approach that creates cascading problems.

Consider a typical market crash scenario. If 1,000 positions need liquidation, current implementations could require up to 1,000 separate transactions. During periods of network congestion (precisely when liquidations are most needed), these costs can become prohibitive, leaving positions unliquidated and may impose bad debt on the protocol.

This inefficiency forces protocols to implement conservative parameters that limit their utility. Loan-to-value ratios are capped at 75-85% to provide safety buffers. Liquidation penalties of 5-15% are necessary to compensate for the high costs and risks liquidators face. These constraints reduce capital efficiency and make DeFi lending less competitive compared to traditional finance.

Risk-Based Grouping

This innovation centers on a simple but powerful insight: positions with similar risk levels should be managed together, not separately.

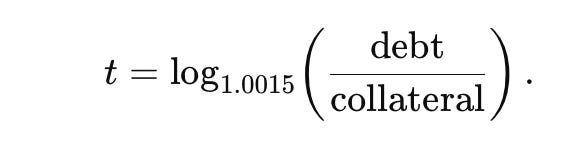

Instead of treating each borrowing position as an isolated entity requiring individual attention, it groups positions by their debt-to-collateral characteristics into discrete risk ticks. Think of ticks as containers or buckets, where each container holds positions that share a similar level of risk.

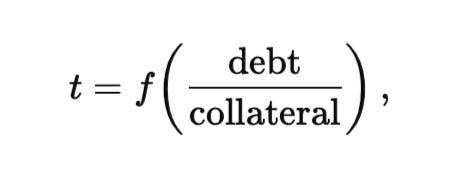

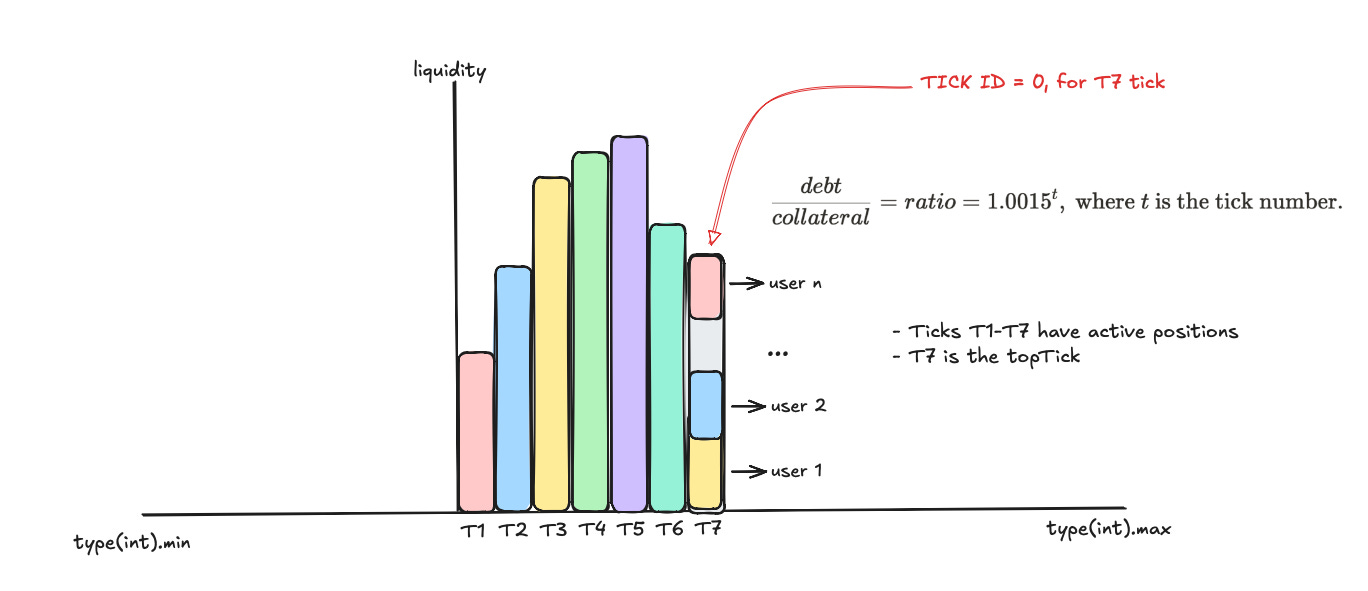

Tick(t) is the ratio of debt borrowed by the user per unit of supplied collateral.

More specifically,

When a user borrows against their collateral, the protocol calculates their position’s risk profile and assigns them to the appropriate tick. As the relationship between their debt and collateral changes, additional borrowing, or collateral deposits, their position may migrate to different ticks, automatically keeping similar-risk positions clustered together.

This creates a dynamic, self-organizing system where risk naturally aggregates. Rather than scattering thousands of individual positions across the protocol, Fluid concentrates similar-risk exposures into manageable units.

From Individual Positions to Aggregated Risk

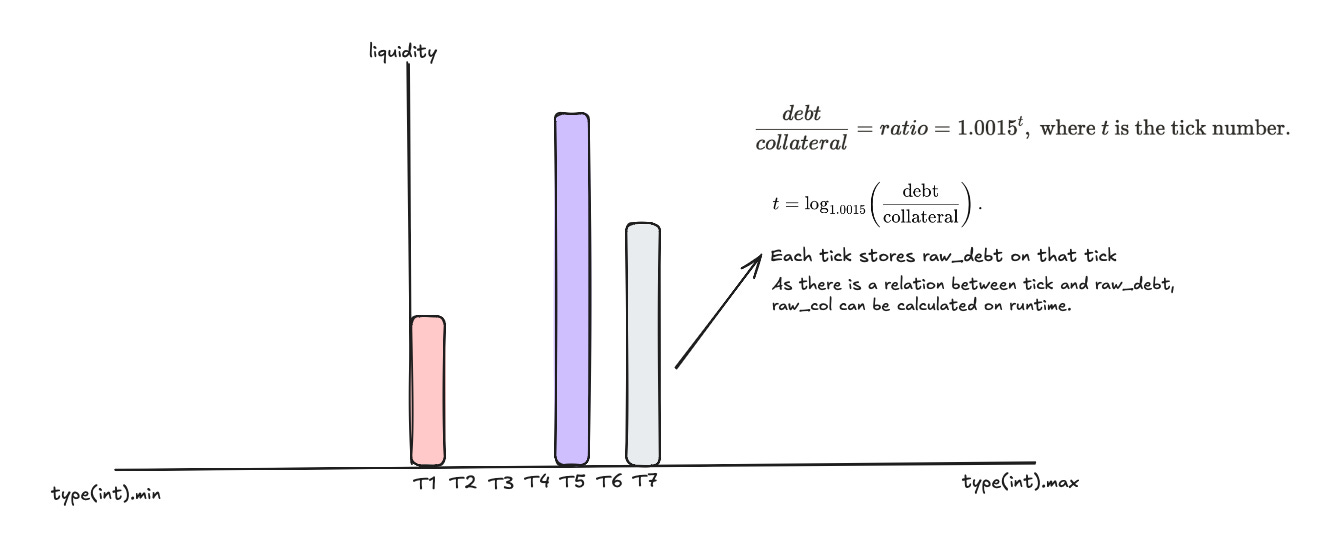

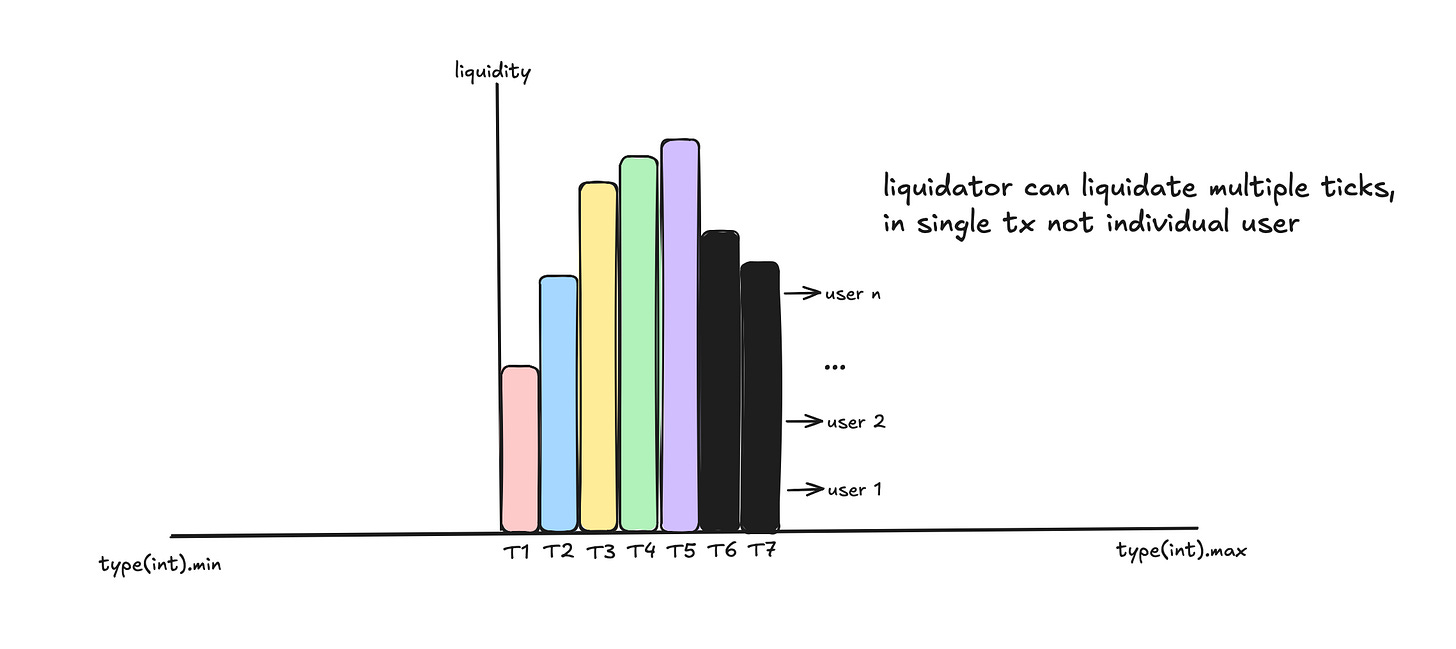

Within each tick, the protocol tracks the combined exposure of all positions at that risk level. If 10 users each have positions contributing to a specific tick, that tick accumulates the total debt and collateral characteristics of all ten positions together.

This aggregation is what makes batch liquidations possible. Instead of liquidators having to process ten separate positions with ten separate transactions, they can process the entire tick’s accumulated exposure in one action.

The system maintains a hierarchy of risk. At the top sit the riskiest positions (or we call it top_tick), those with the highest debt relative to their collateral. Below them, progressively safer positions occupy lower ticks. This organization makes it immediately clear which exposures need attention during market stress.

Traditional liquidation systems also require intensive, per-position tracking, which makes it difficult for anyone but sophisticated bots to participate. Because liquidators cherry-pick only the most profitable opportunities, even highly risky positions can be ignored. For example, a position at a 95% debt ratio may go untouched while a less risky one at 92% gets liquidated simply because it yields better profit. This tick-based model eliminates this failure mode, liquidations always begin with the riskiest exposures, ensuring systemic safety rather than profit-driven selection.

How Batch Liquidation Works Conceptually

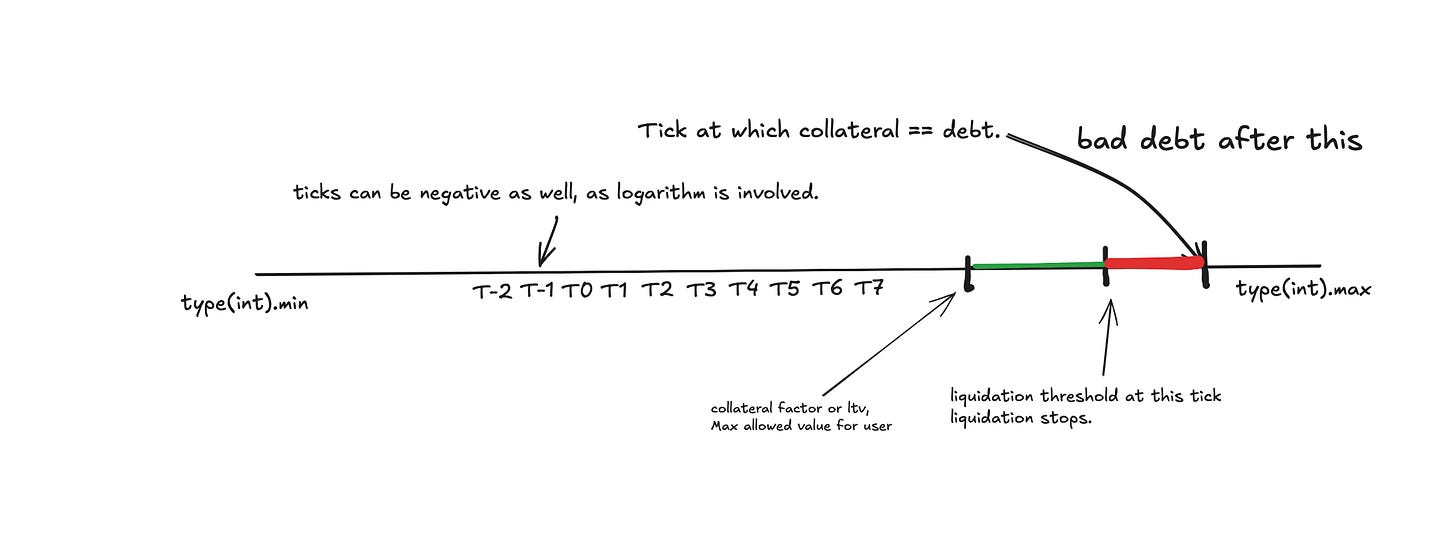

The green segment represents the safety buffer that keeps the user’s position liquid, even during minor market fluctuations. After green line that’s liquidation zone.

When market conditions deteriorate and positions become undercollateralized, liquidation process operates fundamentally differently than traditional protocols.

The protocol identifies which ticks have crossed into dangerous territory based on current market prices and configured risk thresholds. Rather than targeting individual borrowers, the system makes entire ticks available for liquidation.

Liquidators can then step in and process these risky ticks in bulk. A single liquidation transaction can clear the accumulated debt across multiple user positions simultaneously, all grouped within the same tick. If additional liquidation is needed, the process continues flowing through successive ticks until the risky debt has been adequately processed or the liquidation amount is exhausted.

For users, this system provides a more orderly liquidation experience. Rather than a race among liquidators to cherry-pick the most profitable individual positions, the tick-based structure ensures liquidations proceed systematically through risk levels.

Solving a Hidden Inefficiency

There’s another major advantage of this tick-based approach that often goes unnoticed but has enormous implications: precision in liquidation sizing.

In traditional lending protocols, liquidations are not only expensive but they’re imprecise. Because each position must be handled individually, and because running multiple small liquidations would be cost-prohibitive, many systems are forced to liquidate a fixed, oversized portion of a user’s debt often 30–50% in a single action.

This crude mechanism exists for one reason:

It avoids having to repeatedly liquidate the same position every few blocks if the price continues falling.

But the consequences are harmful:

Users lose more collateral than necessary.

Protocols must impose higher liquidation penalties.

Safety buffers must be large, reducing capital efficiency.

This new architecture eliminates this design flaw.

Because risk is aggregated at the tick level and liquidations are executed in efficient batches, the protocol can liquidate only the exact amount needed to bring a position or more precisely, an entire tick back into a safe state. No arbitrary 50% cuts. No oversized write-downs. No excessive penalties just to compensate for inefficient infrastructure.

This precision dramatically reduces both user loss and systemic volatility. Liquidations no longer need large buffers or blunt heuristics; instead, they can be mathematically targeted, making the system safer, more predictable, and significantly more capital efficient.

The Economic Transformation

By enabling efficient batch liquidations, protocol can safely support higher loan-to-value ratios, giving users access to more capital efficiency without increasing protocol risk. The system can operate with tighter liquidation penalties because the friction costs of liquidation are dramatically reduced.

Market impact is also significantly diminished. Instead of a chaotic rush of individual liquidations creating price volatility, the tick-based system allows for more coordinated risk management.

Perhaps most importantly, the system scales. Traditional liquidation mechanisms become more problematic as protocols grow, more users mean more individual positions to track and liquidate. Fluid’s approach actually becomes more efficient with scale, as more users mean better risk aggregation within ticks.

Fluid has created a system where liquidations are no longer the bottleneck constraining what’s possible in decentralized lending. The protocol can maintain security and solvency while offering users better capital efficiency and liquidators better economic opportunities.

But how does this actually work under the hood? How exactly are ticks calculated? What determines when they become liquidatable? How do the mechanics ensure fairness and precision across all users in a tick?

Coming in Part 2: The mathematics of tick calculation, liquidation thresholds, partial liquidations, and the precise mechanics that make Fluid’s batch liquidation system work in practice.